DOMINATION REPORT

A Closer Look at Gold as a Monthly Income-Producing Investment

2017 has ushered in a new administration, along with a rapid spike of growth in the stock markets. The Dow broke through the 21,000 mark. That’s a 325% increase since the low of 6460 in February 2009. It has been a wild eight-year run-up in all of the equity indices.

But how long can it last?

Some pundits see a Dow 22,000 and above in the short term. The question in the eyes of many is how sustainable is this surge in stock prices? Many argue that the growth is based on optimism and speculation, and not on technical or fundamentals. While there is still room to the upside, a growing number of experts warn that a correction or even a “crash” is imminent. Many billionaires and Hedge Funds have already moved out of their stock positions and on to the sidelines.

When corrections happen, the impact can deliver a shocking blow to individual investors. The last major correction saw the Dow drop from 14,267 down to 6,640. If you were long in the markets in late 2007, you saw over 50% of your portfolio erased over an 18-month period.

Another correction of the same magnitude would see Dow 22,000 drop to 11,000 or less.

I’m not trying to predict where or when a correction will happen, but when it does happen, I wanted to protect myself from the crash, while potentially finding opportunities for gains. This led me to looking more closely at gold as an investment.

Experts Warn About Upcoming Stock Market Crash. Are You Protected?

Learn How Investing in Gold ETFs Can Yield Consistent Monthly Returns

Regardless of Which Way the Market Is Moving

Click Here to Register for this Free Video

In the chart below, you will see the price of Gold Futures over the past eight years compared to the S&P 500 Futures market.

Notice that there’s an inverse relationship between the price of Gold and the S&P 500. As the S&P 500 goes up, Gold prices normally go down. And when the S&P 500 goes down, the price of Gold goes up.

Over the past eight years, the price of Gold has dropped from a high of 1,911.60 in August 2011 to today’s price of 1,237 – a $674 drop in price. Meanwhile, the Dow is at 21,000.

Technically speaking, the Dow is overbought while Gold is oversold.

With this in mind, I started doing some research on Gold as both an investment and as a hedge against an impending market correction. This led me to the “Gold and Silver for Life” program by Minesh Bhindhi.

The “Gold and Silver for Life” Program, by Minesh Bhindi

I registered and sat in on a 3 Hour video by Minesh. I’ll be honest, 3 hours is a lot of time to watch a video, but I reminded myself that that I needed to do my homework to consider Gold as an investment. I also reminded myself that if the video didn’t hold my attention, I could always turn it off.

I found Minesh to be very engaging as a speaker, and I really didn’t want to exit the video. After a brief introduction, he opened my eyes to the pitfalls of investing in today’s markets, including:

- Choosing High Risk Investments (High Frequency Trading can kill the average trader)

- Chasing Opportunities (the Smart Money is way ahead of you)

- Continuously Readjusting Strategies (almost guarantees losses)

- Trading Highly Leveraged Instruments (Makes you take actions you don’t want to do)

- Following the Advice of “Misguided Gurus” (Who are more interested in collect fees)

What Minesh presented in the video was a framework that provides Three Key Elements for Long-Term Success:

- Simple strategies that can be consistently applied

- Consistent support and market specific guidance

- Willingness to act confidently when the time is right

Why Gold Now?

Minesh thoroughly covered the history of Gold over the past few decades, and the preponderance of evidence supporting the value of investing in gold not only as an investment, but for monthly income generation. Some of these factors include overvalued stock markets, governments printing money at an uncontrolled pace, and a fractional reserve lending model. Increasing debt, combined with irresponsible Central Bank policies and the printing of money is leading toward a bubble that will ultimately burst, and it might make the 2008 crash look like a walk in the park.

How to Invest in Gold

There are many ways to invest in Gold. This can include buying Gold Bullion, collectible coins, Spot prices vs. Dealer prices, even Network/MLM companies. With each method, Minesh clearly illustrates both the pros and the cons.

Minesh focuses on an Advanced Strategy for investing in gold, primarily through ETFs and Options. When you are finished watching the video, you will know the risks of buying physical gold, along with the advantages of trading Gold ETFs and Options when the time is right, and compounding your returns, yielding monthly cash flow and income.

The first 90 minutes of this presentation covers the pros and cons of investing in the physical asset of Gold, and introduces you to the “Gold and Silver for Life” method for investing in ETFs and Options pegged to Gold and Silver for monthly income.

Questions & Answers

You are bound to have many questions, and the second 90 minutes of the video is devoted to questions and answers, including detailed answers to the following questions:

- How does the Gold & Silver ETF work, and what do I own?

- Can I withdraw my money at any given time?

- What are the Tax implications?

- What are the biggest risks of the program?

- If the ETF goes down, how do I earn money?

- How is it possible to make 1%-2.2% in downward markets?

- Can I use metals I already own to generate cash-flow?

- Can I use the broker I already have?

- What’s the minimum starting investment?

- Can I pull out income monthly?

- How much “work” do I have to do to follow this program?

- What percentage of my portfolio should be allocated to Gold & Silver?

- And several more questions.

The “Gold and Silver for Life” program does not promise windfall returns. Rather, it’s a program that can generate consistent monthly returns without going through the roller coaster emotions and losses incurred trading the markets. The program boasts a 1%-2.2% success rate per month with a 92% independently verified success rate.

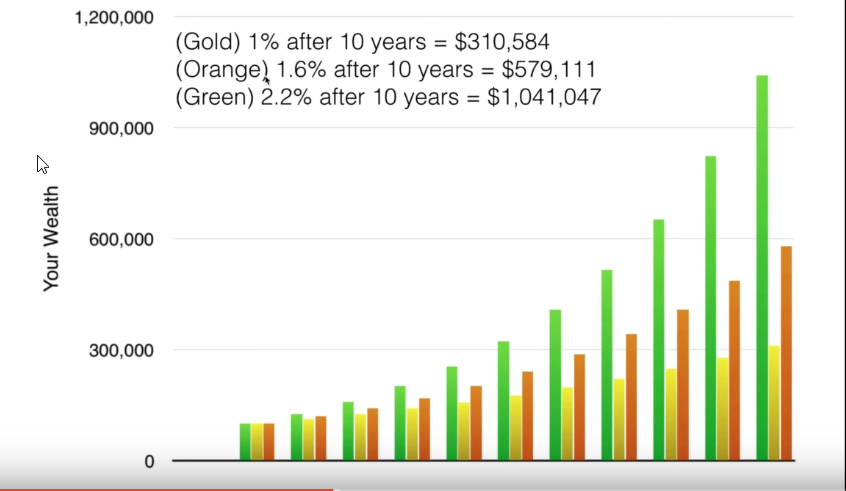

What does a 1%-2.2% per month Success Rate look like?

This is a chart of a 100,000 starting portfolio over 10 years.

- An average 1% monthly gain would return $310,584 over 10 years

- An average 1.6% monthly gain would return $579,111 over 10 years

- An average 1% monthly gain would return $1,041,047 over 10 years

Conclusion

In my view of the stock markets, an imminent correction or crash is not a question of “if”, it’s more of a question of “when”. The real question in my mind is “How ugly will the correction be”? When the crash happens, Gold could potentially skyrocket in price from today’s levels.

If you have been thinking about investing in Gold, then this video is well worth your time. You will leave the video with a much better understanding of how to invest in gold and generate monthly income.