DOMINATION REPORT

Knowing the Market's “Appetite for Risk” Can Make You Money

A Special Report from our Associates at Money Morning:

Traders and investors love when things play out according to plan - when everything moves along in a "normal" way.

Well, that's a no-brainer, but what's often less clear to folks is: What exactly does "normal" look like?

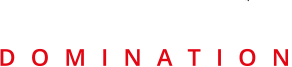

Look at the four major U.S. indexes: The 30 blue chips of the Dow Jones Industrial Average, the big, broad S&P 500, the tech-centric Nasdaq Composite, and the dynamic small caps of the Russell 2000.

There's normally a distinct rhythm playing out; certain indexes move to extremes when certain themes predominate, and understanding where the money is moving among the "Big Four" is key to staying ahead of profit potential.

"Risk On, Risk Off, Risk On, Risk Off"

At one end, we have the most volatile - which is to say, riskiest - indexes. The Russell 2000 and the Nasdaq hold down this end of the scale.

Historically, when the stock market is moving up, these two indexes move up the fastest. And when the market turns down, these two drop the fastest. This is why the pros refer to them as the "Risk On" indexes.

On the other end, we have the Dow - the least volatile, least risky of the four big indexes. It's narrow, blue-chip composition means it runs up more leisurely in bull markets and drops less quickly when the bears run. So it's a "Risk Off" index.

In between these extremes, we have the benchmark S&P 500 index. The "Goldilocks Index," not too hot, not too cold, not too volatile, not too flat. Right in the middle. It's made up of 505 stocks issued by - you guessed it - the 500 biggest companies trading on the U.S. exchanges. Close to 80% of the equity market by capitalization lives here.

America's Legal "Frontrunners" Are Helping Drive Up Shares...

Most of us wouldn't touch these stocks. But this group knows in advance, when they target a company, they have the power and influence to send the price soaring within a matter of days.

Click Here for the Report

So, now that we know how the indexes "want" to behave, we can say that, as far as the markets are concerned, things have been going pretty much according to plan - just like I predicted.

Except for one thing: Recently, the Russell 2000 has been consistently lagging in performance in the strong "up market."

Here's what that means...

You see, the Nasdaq and the Russell 2000 are the two "go-to" indexes for bull markets.

When one is clearly stronger than the other, it's typical for money to rotate out of one to the other - which is exactly what happened in the first half of 2017.

While the Nasdaq charged ahead, the smart money flooded into that index, leaving its Risk On cousin in the dust.

We can see this action, along with the other traditional Risk On behavior, in this chart...

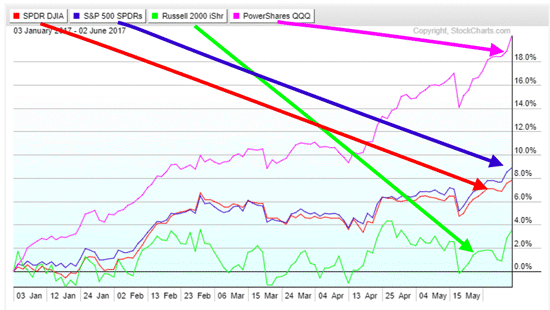

Then things got a little weird.

From the "Tech Wreck" of June 6 right up until July 5, the markets acted outside the normal model.

The Nasdaq and the Russell 2000 flipped, and the Dow outperformed the S&P 500.

Here's the chart of how it played out...

As I've written recently, the fact that the money rotating out of the Nasdaq found its way into the Russell 2000 is very significant.

This is a big, bright green signal that the market still has a Risk On, or upward, bias. It "wants" to go in one direction: up.

If the market's participants were more defensive, or heading into a Risk Off posture, the cash fleeing the Nasdaq would have gone into the Dow, propelling it to the very top of the heap, or rotated completely out of stocks and into bonds.

And as you can see on the chart above, bonds were actually down a bit during this period - another classic Risk On behavior by market participants.

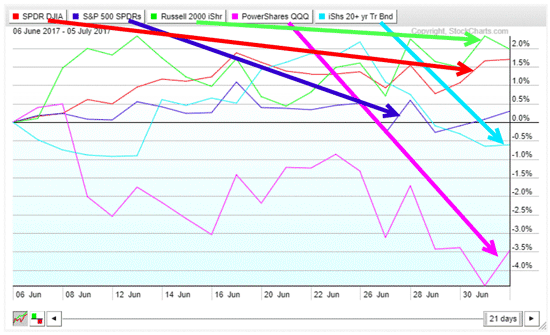

In addition to this mixed-up activity, we had a period from the end of June through Wednesday of last week when the indexes' movements became chaotic - some going up on the same day others went down - giving the market a very uncertain feel...

So, now that we understand a little more about how the market has been moving recently, let's take a look at the best ways to make money.

As I often say, buying otherwise strong stocks when sentiment or technical factors drag them down is always a smart move in the long run.

But it's a good idea to switch up trading tactics in the near term.

With all of this uncertainty in the market, normal-duration directional trades become coin flips - not something I'm fond of doing.

Fast is the key here. Quick, short-duration trades - calls on stocks heading up, or puts on stocks going down - are the way to go here. As I said last week, trades on index exchange-traded funds are a good way to find an edge and make some quick cash in 12 or 24 trading hours. That way, if you hit on a profitable trade, you can roll your money over quickly. If your trade's not working out, you can pull your capital out and look for the next trade - just don't chase anything.