DOMINATION REPORT

They Trade Better Than You

I used to manage a CTA fund.

CTA stands for Commodity Trading Advisor. It is a managed program similar to a hedge or mutual fund, but only trades commodity futures - oil, nat gas, ags, indexes and the like.

I didn't trade it.

I worked with a well-respected trader in the industry. He traded the accounts. I handled the paperwork, clients, brokers, give-up fees, allocations, etc.

We started small. We raised a little less than $10 million and set out to establish a track record.

The goal was simple - return a steady 8-10% a year with minimal drawdowns (minimal being less than 5%).

Do that, and we were assured that it would be no problem to raise another $50 to $100 million.

Five months later the fund was down more than 27%.

Some investors used notional funds. They added leverage with the hopes of even larger gains. They lost everything.

I thought this trader was a god. Thousands of people followed him and hung on his every word.

I watched him trade his personal accounts for years. I knew he was legit.

He called me once on his way in to the office to get a quote on Apple. I gave him the stock price. He then asked me to close out a "little trade" he had put on the day before.

I closed out the position for a $207,000 profit - not bad for a day's work.

A year later I watched him make a million dollars in a single day.

If this guy couldn't make money trading a fund, who could?

I stayed away from CTA's for a while after that. I was sour on the whole industry. I thought the whole thing was a scam.

Last week I had lunch with David. He's a good friend of mine works in the same building as I do. I've literally known him since we were 14 years old.

I've always known what he did, but never took much interest in it.

David raises money for CTA programs. But unlike the rest of the sharks in New York and Chicago, his obligation is to his clients (weird, right?).

I would compare his job to that of an independent insurance broker.

Instead of calling a dozen agencies to get quotes, you call someone who can compare rates and coverage for you.

Need to insure your mint 1951 Jaguar XK 120? They know what companies specialize in collectibles.

Have a perfect driving record? The insurance broker knows what companies will best reward your impeccable history.

This is what David does, but for investors.

If you have a low risk tolerance and want to earn a consistent 6-8% he knows what programs are best suited for you.

If you are a former day trader who doesn't bat an eye and 25% drawdowns, he may suggest CTA's with much higher potential returns.

I sat down with him this week to find out more and get an inside look at the managed futures industry.

I wanted to know, once and for all, if CTA's are a viable alternative investment.

After grilling him for several hours and asking to see everything short of client statements, I was surprised at what I learned.

Question 1. I asked him point blank: "Why would I invest in a CTA?"

"They trade better than you." His answer came straight-faced, without missing a beat.

I appreciated his bluntness. The financial services industry makes a living with slick rebuttals and well-rehearsed answers, so his response was a breath of fresh air for a fellow straight shooter like myself.

So I continued.

He knows about my CTA experience and my skepticism over an industry that racks up more commissions than a busy eBay weekend.

As I suspected, not all of them are such legendary traders. Out of the more than 1,000 CTA programs in existence, David only recommends 6 to 7 of them to his clients.

Just like top stock pickers, he only puts money into thoroughbreds - those expected to offer less risk and greater upside than their peers.

So what should CTA investors look for?

First and foremost, you want to see above-average returns over a rolling 12-month period. The fund needs to not only have outperformed in the past but still be doing so. It doesn't matter if they were hot three years ago. As the saying goes, 'What have you done for me lately?'

David also recommended a MINIMUM 24 months of proven track record before one considers investing.

The minimum is for those traders with proven pedigrees. Maybe they ran a successful program previously (if so, the details will be in the fund's disclosure document). Maybe they spent a decade on Goldman's commodity desk.

If their resume doesn't impress you, require at least 36 months of solid returns.

Every day someone decides to hang their shingle and trade other people's money. A vast majority of them, like my former colleague, crash and burn. As a potential investor, I want to see that the trader has performed satisfactorily under different markets and conditions.

The key in judging performance, from what I can tell, is the ratio between drawdowns and average returns.

Drawdowns are defined as the maximum fluctuation between high and low values. Some may refer to it as peak-to-valley moves.

A 20% return is not appealing if the fund regularly sees 50% dips. Conversely, 10% per year with a 2% max drawdown is very attractive.

In fact, the annual return percentage doesn't even matter.

The reason? Notional funds.

Unlike traditional mutual funds, CTA investors can partially fund their accounts. This adds leverage and amplifies both gains and losses.

The CTA terminology is "units."

Let me give you a hypothetical example.

XYZ CTA program has a $100,000 minimum initial investment. So every $100k is referred to as a unit.

Some will trade one contract per unit. Others may trade several. It all depends on the market and volatility of the fund.

The XYZ program has an average annual return of 7% and its largest drawdown was 2%.

Since the program has been in existence for many years, odds are they have risk parameters in place designed to avoid anything larger than their maximum 2% decline. Nothing is guaranteed, but this would be my educated guess.

As an aggressive investor, 7% may not do much to wet your whistle. To increase the potential returns, you can simply trade more units.

Pretend that you have $100,000 to invest.

Instead of trading 1 unit, you may decide to trade 5. This will increase both gains and losses by 500%.

In essence, the CTA will be trading a $500,000 account in your name. But you are only required to put up $100,000 to fund it.

By trading 5 units instead of 1, the program's average return increases to 35% (7% * 5) and the largest historical drawdown would be 10% (2% * 5).

This is the concept of notional funds.

The same managed futures program can be very low risk or very high risk depending on your personal tolerance. As the investor, you are in control of how many units you wish to trade.

This is why the ratio between returns and drawdowns is so important. You have the power ratchet up or down the performance of any program through the use of notional funds.

At first glance, a CTA that is regularly returning 50% seems appealing. But if the downside swings are equally severe, I'm not interested in participating.

And why would I? I can make any fund average 50% returns. I just need to be comfortable with the corresponding drawdown risk that my use of leverage creates.

So enough hypotheticals. What are these people actually making?

David has been in business for almost four years. He has around 100 clients. He estimates that, on average, most of them make about 35% a year.

Remember, most of these people are trading with notional funds - some as high as 10 times leverage. Many also come from a trading background and are comfortable with higher risk levels.

I cannot give you a performance number to target. Every investor must weigh the historical returns with an educated guess of the risk based on the program's history.

Is a managed futures program right for you?

I can't answer that. I will say that like any other investment, you don't want to put all of your eggs in one basket. Diversity is key.

One of the appealing things about these CTA programs is their lack of correlation with the overall stock market. A fund trading meat futures (apparently one of the best ones out there believe it or not) is not likely to be affected by interest rates and corporate earnings forecasts like a stock fund would be.

And having investment dollars that can produce a positive yield during lean market years is never a bad thing.

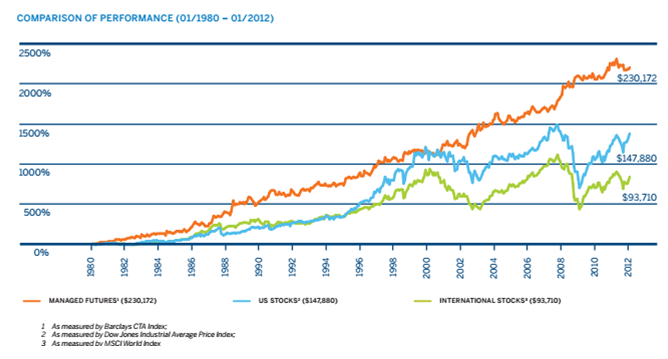

(chart courtesy of CME group)

The chart above shows the performance of managed futures (orange) against the Dow Jones Industrial Average (blue) and the international stock index (green).

I use it not to highlight outperformance but to show the lower volatility of the asset class and its lack of correlation to equity markets.

Unlike most hedge funds, CTA programs also have no lockup periods. If you need to liquidate for any reason, you can usually have your money within 48 hours.

Managed futures may very well fill a void in your investment portfolio. Notional funding allows investors to achieve nearly any risk tolerance in a variety of uncorrelated markets.

If you decide to explore this option, I would strongly recommend using an introducing broker like David who specializes in these programs. He gets paid by the CTA so it won't cost you an extra dime.

This broker can also serve as a valuable point of contact for you. He can answer questions about what and why your CTA is doing and offer an additional layer of oversight for your hard-earned dollars.

Most also do regular client reviews and even stay abreast of new funds that may suit your needs.