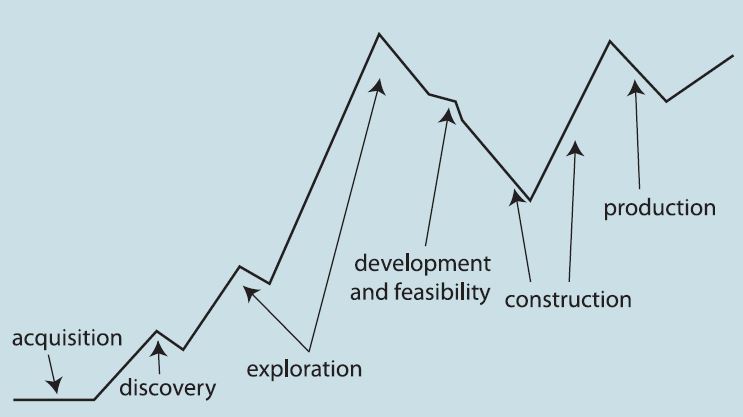

Mining companies are evaluated in different ways depending on their stage of development

When examining the financial statements of a junior exploration company, you will not be able to ascertain a precise value for its mining project before it reaches production and, hence, its stock price. Many aspects go into determining the value of a mineral property – not just calculating how much of the commodity exists and multiplying the ounces or pounds. It is almost never possible to mine 100% of a deposit and it is almost impossible to mine just the orebody as some unmineralized rock will need to be mined as well.

Then there is the cost per ounce or pound to mine that depends on whether the mine is an inexpensive open pitting operation or an expensive underground mine. Add to that the processing costs, whether an access road or camp needs to be built, on so on.

However, it is possible to obtain a rough estimate of what a mining company’s share price should be. The investor’s goal is to weed out those companies with a low chance of success and identify those companies with a good shot at success in an inherently risky business.

But before you invest in any kind of stock, you must know what kind of investor you are. Can you stand the stress of owning shares in a high-risk/high-reward junior exploration company or are you more comfortable owning shares in a company operating a producing mine with revenues?

To start off, one has to understand the exploration process. In a nutshell, this is how the Canadian mining industry works. I say Canadian because Canada has the most publicly-traded mining companies in the world. Being a resource-rich country, stock exchanges in Canada (Toronto Stocks Exchange, TSX Venture Exchange and the CSE) were and are still geared to facilitating the raising of funds for mineral exploration. As a result, Canada’s resource sector has played a major role in the economic development of the country. Naturally, exploring for mineral deposits as well as building and operating mines requires talented geologists, geophysicists, financiers, engineers, accountants, lawyers, and workers with a variety of skills.

Today, Toronto, Ontario and Vancouver, British Columbia are home to the majority of both junior and senior mining companies. In fact, there are some 700 junior resource companies within a 10-minute walk from the offices of Resource World Magazine, our flagship publication here in Vancouver.

This heavy concentration of talent are constantly seeking good mineral projects just about anywhere in the world. It is not unusual for a junior resource company to evaluate dozens, sometimes hundreds of potential property acquisitions before choosing one they believe has potential. I say ‘potential’ because unless the property has an operating mine or has had a completed favorable feasibility study, it is still an unknown as to the economic viability of the project.

In a typical scenario, either a prospector approaches a mining company with his mineral property or, as in many cases, a junior exploration company identifies a good property. If the mining company likes the prospector’s claims, they will either buy the property outright or option it in stages whereby they can walk away if the first-stage exploration results are poor. Junior mining companies also stake their own claims in prospective areas – sometimes on a computer map and sometimes in the field depending on the jurisdiction. If the junior company defines a significant mineral deposit, it can either sell the project or the company itself to a senior company. On occasion, a junior may decide to build a mine on its own if it can raise sufficient financing and figures it has the ability to build and run a mine which is a very different skill set than mineral exploration.

The old prospector’s adage that “the best place to look for a mine is near a successful one” is usually true. Nature often emplaces mineral deposits in clusters or trends. That’s why there are mining ‘camps’ such as the Sudbury, Cobalt, Timmins and Kirkland Lake camps in Ontario or the Abitibi region of northwest Quebec. This is also true for diamond deposits where the Lac de Gras region of the Northwest Territories boasts several operating diamond mines.

Therefore, by following an important mineral discovery, other explorers will stake claims ‘along strike’ of the mineral trend in hopes of finding another deposit. This is an important consideration for the mining stock investor since the share price of companies with claims adjacent to a discovery will often show great increases – even if they have not found anything of value. This is nicknamed ‘closeology.’

Mining companies can be divided into five categories:

- Grassroots explorers seeking an ore deposit

- Companies that have found an ore deposit and are defining its size and grade

- Companies that have defined a deposit and are preparing a feasibility study to determine the economic viability of the project

- Companies that have completed a bankable feasibility study proving the economic viability of the project

- Companies that are actually mining and producing a metal or mineral commodity

Grassroots Projects

Companies seeking to find a mineral deposit on a grassroots exploration project don’t blindly stake any old piece of ‘moose pasture.’ There has to be some kind of geological evidence that there could be a mineral deposit on the property. At an early stage, this evidence might include receiving attractive assays from the sampling of rock outcrops. However, stock buyers must beware, because what are called grab samples are usually the best looking samples the geologist can find. This means that while the metal grades might be very good, a grab sample is not representative of the typical mineralization on the property. However, high-assaying grab samples do prove there is attractive mineralization on the claims.

Following up on good samples, the exploration company may elect to conduct a geophysical survey over its ground – either from the air or the ground. There are maybe six or seven common geophysical surveys in use – magnetometer, electromagnetometer, gravity, resistivity, induced polarization and radiometric, to name a few. The average investor does not have to understand how to operate geophysical equipment. It is only necessary to understand the results, that is, did the survey define a geophysical anomaly that will be a drilling target? One can imagine that if there is a great deal of metal buried in the earth, that it has to have some kind of effect on the earth’s magnetic field, hence, a magnetic survey will measure the differences in the earth’s magnetic field in the area of interest.

A geophysical survey is often accompanied by a soil sampling program. Over thousands of years, tiny amounts of metal in a buried mineral deposit will gradually work their way upwards from the bedrock into the soils. Therefore, sampling soils can indicate there is a mineral deposit below. However, it is important to keep in mind that neither geophysical or soil surveys will indicate if there really is a significant mineral deposit below. The surveys only provide valuable clues and identify targets to drill.

The geologist will hope the geophysical and soil surveys will be ‘co-incident’ – in other words, on top of each other. Using the data from the surveys, promising targets can be picked for drilling. A diamond drill is often used to test these targets. The drill bit is studded with industrial diamonds in order to cut through the bedrock to recover core. The core is then cut in half and one-half is sent to the lab for assay and the other half is saved for study and display.

A diamond drill can be called a truth machine as it will truly determine what lies beneath. Many times diamond drilling will kill a project as the drill results just are not good enough to continue.

This is a crucial stage in the exploration process. While one drill hole does not make a mine, a high-grade intersection over a considerable length (discovery hole) can have an instant and dramatic effect on a company’s share price. When the company recovers many drill cores indicating good metal values over long intercepts, the share price usually reflects the value of the discovery – but not always. This is where promotion comes in.

The investing public has to be aware of the discovery in order for investors to bid up the share price. It is important for the mining company to get its story out there to investors. When you don’t promote, a terrible thing happens – nothing. Companies with good projects make sure the mining media know about their project in hopes of receiving ‘good ink.’ In addition, companies will buy advertising in investor-related publications and set up booths at resource investor conferences. By the time the mainstream media gets a hold of the story, usually the big moves in the share price have already been made.

On the other hand, stay away from companies that are overly promotional and make promises such as, “This stock’s going to $5.00.” The stock might go up on misleading information, false promises or manipulation, but at this stage nobody knows what the stock will actually do.

It behooves the investor to stay on top of exploration activities since a stock price will frequently drift lower for a considerable time, and then make a sudden move higher. The astute investor will try to identify those companies that have good potential, buying its shares at a low price in anticipation of higher share prices in the future.

Companies with grass roots exploration projects can’t really be evaluated in any kind of actual monetary sense because, obviously, there isn’t anything of value (yet). That’s why it is so important to choose a company with competent management, preferably with people who have a successful track record.

In addition, the company must have sufficient funds to carry out exploration, or the ability to raise them. Being junior explorers, the vast majority of them don’t have any revenues, yet mineral exploration is very capital intensive. So juniors live on private placements, that is, investors who buy large blocks of shares directly from the company that are sometimes accompanied by warrants for enticement. It’s also good if management owns lots of shares as that’s an incentive to do well.

Finally, the project has to have some kind of significant mineral potential. Perhaps the project is in a proven mineralized area like the Carlin Trend of Nevada or some other prospective ‘address.’ Or maybe the company has a commodity that is in great demand. Perhaps there may be compelling geological evidence that there might be extensive mineralization.

It is companies at the grassroots stage that can realize tremendous share price gains when they intercept significant mineralization over decent widths. However, keep in mind that most exploration projects are long shots and it may be prudent to sell your position on the rising optimism of investors that have bid the stock up higher in eager anticipation of great drill results. If a company receives poor drill results, you can bet its share price will tumble quickly – it’s time to get out fast. It is generally not a good idea to put serious money into a highly speculative grassroots stock.

Companies with a Mineral Deposit

Once a company has identified a mineral deposit, the next steps are to determine its size, geometry and grade. In the past, different geologists in different jurisdictions reported mineral resources and reserves according to their established custom. Since mineral resources and the higher category of reserves could be reported in different ways, it was sometimes confusing to the investor. To make a level playing field the National Instrument 43-101 reporting standards were created requiring geological data, including the reporting of resources and reserves, to be disclosed in a specific manner by a qualified person. With everyone reporting data the same way, it is a more fair and consistent system of disclosure.

Bear in mind that a geological or mineral resource is not an economically proven orebody. It has to be moved up to the reserve category, typically by drilling , followed by pre-feasibility and feasibility studies to be considered economically viable. Mineralized rock is only considered to be ‘ore’ if it can be mined at a profit.

Sometimes a mineral property may have resources or reserves that were calculated many years ago, perhaps in a foreign country. In these cases, the company must disclose that these resources or reserves must be considered as historical resources and do not comply with NI 43-101 standards. This means the investor cannot rely on these numbers to evaluate the company’s mineral assets; however, the old numbers are valuable in that they support the premise that there is a significant mineral deposit present. It is up to the company to upgrade the historical figures to comply with the new reporting regulations. What are called ‘step-out’ holes will define the extent of the deposit, while ‘in-fill’ holes will determine the continuity of grade.

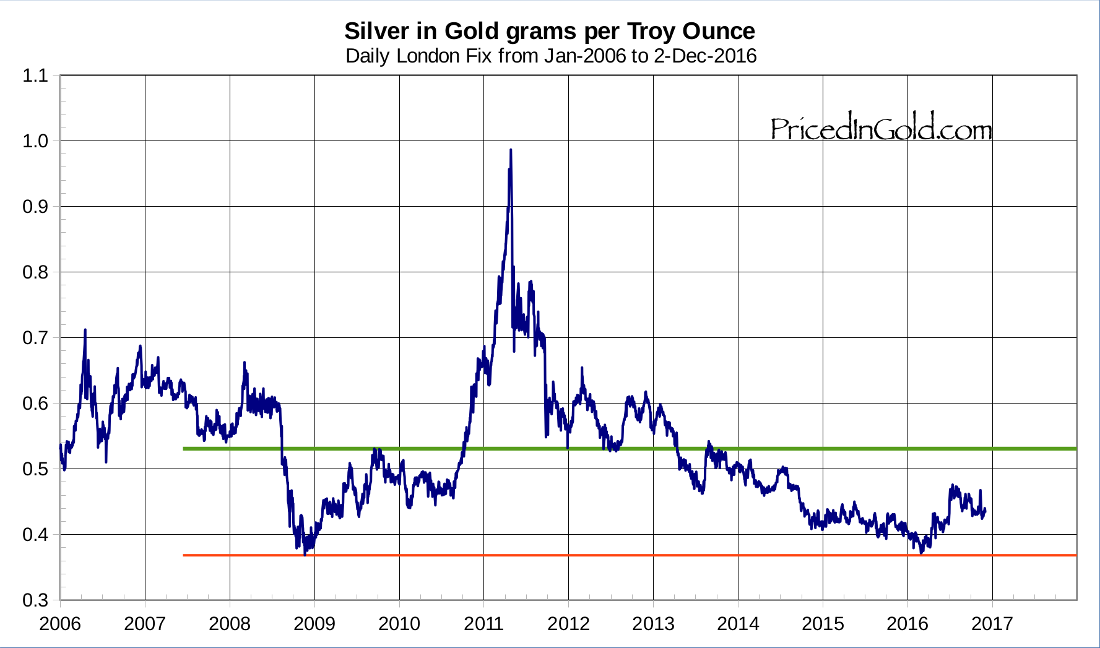

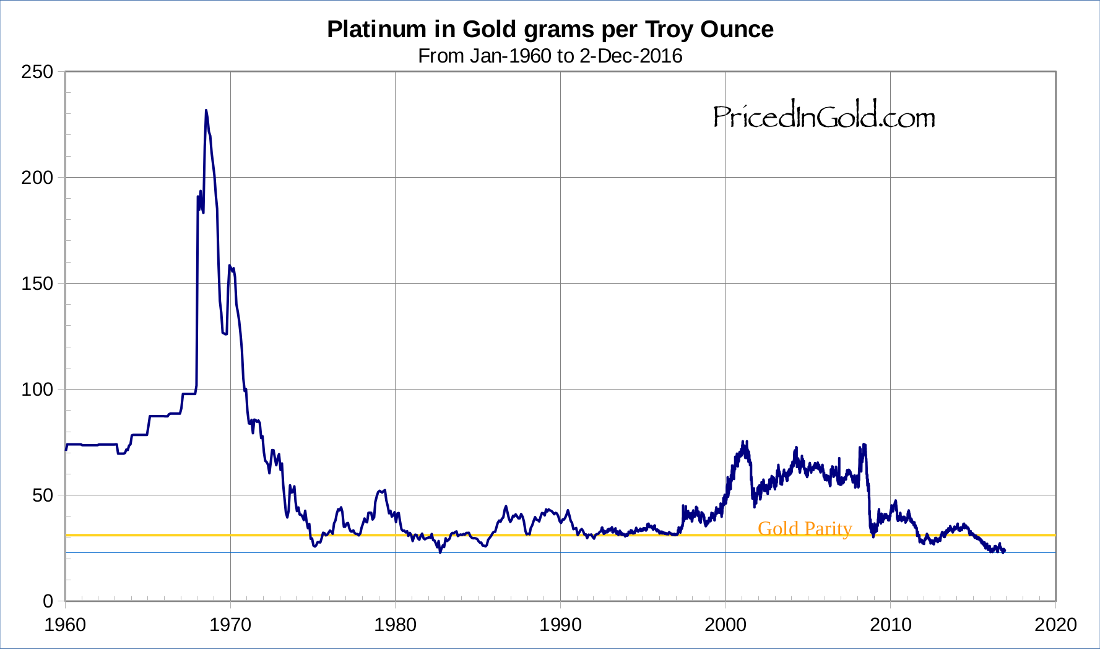

When the company has released resource or reserve figures, its share price is susceptible to the ups and downs of its particular mineral commodity.

In addition to delineating its mineral deposit, the company will probably undertake metallurgical studies to determine the recoveries of metal from its mineralized rock. There are a number of chemical and physical factors that come into play, but basically, if the metal cannot be extracted economically, there won’t be a mine.

At this stage in an exploration company’s life, the release of a substantial resource or reserve estimate can positively affect its share price. While these figures can only be considered as a rough guide, it does help in figuring out what the company’s value should be – see Example 1.

Example 1 represents the in situ (in the ground) value of metal and does not take into account any dilution during the mining process, that is, the cost of removing waste rock, metal recovery percentage, cost of diesel fuel and other expenses. In an open pit mine, there is the strip ratio with which to contend – how much overburden and waste rock must be removed to get at the mineral deposit? Don’t view the final figure as a real value. All it tells you is that the company does have a substantial resource. The per share basic valuation is, therefore, just a ‘ballpark’ figure predicated on a rough rule of thumb of a conservative 5% of the gross metal value. The 5% is usually used for base metal project evaluations; however, gold project evaluations sometimes use a higher figure.

Keep in mind that investors and mining analysts like large tonnage mineral deposits as opposed to small vein-type deposits, so look for projects that have potential to expand resources. A press release might say that “the deposit remains open along strike and to depth.”

It’s a good idea to become familiar with the common types of mineral deposits and their implications, for example, vein, porphyry, skarn and volcanic massive sulphide (VMS) deposits. Vein deposits often have high grades with low tonnage, while porphyries and VMS deposits have large-tonnage, low-grade deposits. Skarns can be any size and shape with quite variable grades. Therefore, the investor is looking for high grades in vein deposits which, by their nature, are usually not too wide. However, the lower grade porphyries have got to have substantial widths in the tens if not hundreds of metres for drill results to be considered favorable.

Generally speaking, an open pit mine needs at least 0.8 grams gold/tonne (0.023 oz/ton) over several hundred feet to be economic. Underground mines need considerably higher grades – usually over 5.0 grams gold/tonne (0.148 oz/ton) over a mineable width – since underground mining costs are much higher than open pit mines. The economic threshold for underground mines also depends on how deep the orebody is and its geometry.

When evaluating diamond companies, the evaluation criteria are somewhat different. Metals such as gold and copper are elements – they are what they are – however, there are literally thousands of categories of rough diamonds because their value depends on clarity, colour and weight (carats), inclusions, etc. Therefore, diamond reserves are based on the value per carat per hundred tonnes.

Uranium projects are similar to base metal projects. The investor looks for good values over reasonable widths. Outside of the Athabasca Basin of Saskatchewan, where uranium grades can range up to 20% U3O8, most other projects will have much lower grades; however, those can still be economic. Like other metal projects, uranium projects can be evaluated on the value of the rock per tonne.

Feasibility Stage Companies

Companies that have defined a significant mineral deposit still won’t know if a mine can be financed and built until it completes a feasibility study. Hopefully, the company will have completed a preliminary economic assessment (scoping study) or a pre-feasibility study earlier. If these initial studies are favorable, one can have more faith the project will be successful. In other words, the project has been somewhat de-risked.

In a formal feasibility study, engineers will take into account drill results (length of intercepts and grade), the size and shape of the deposit, availability of electric power and water, road, rail and/or tidewater access, availability of skilled labor and the location of the project. Mining projects in the Arctic will need higher grades to be economic as compared to similar projects in the south.

This stage can be a nerve-wracking experience for both the company and its shareholders. A recent feasibility study of a junior company was not viewed as positive by investors and the company lost 2/3 of its share value in one day. Many things come into play when an independent consultant prepares a feasibility study, including information an investor would not be aware of. This would include the geometry of an ore deposit. If an orebody is horizontal or vertical in shape, the mining process is straightforward; however, if the orebody is odd-shaped, this can greatly increase the cost of mining. In addition, metallurgical test results must also be incorporated in to the study, the cost of flying or trucking in diesel fuel, the cost of building a permanent camp, the cost of power, and so on.

With a feasibility study in hand, the investor can now carry out a more accurate evaluation of the company – see example 2, 3 and 4.

The calculated figures in examples 2, 3 and 4 work well for base metal companies; however, gold projects tend to be more of a ‘hybrid’ in that more weight is often given to how many ounces of metal are in the ground. Another important figure is the Internal Rate of Return (IRR). The IRR represents the life-of-mine cash flow coupled with the capital investment. A project with an IRR of 30% to 35% would be a financially robust operation. Also, look for projects with a capital investment payback of two to three years, which also indicates a financially robust operation.

Producing Mining Companies

The only category of mining companies that can be evaluated like other industrial companies are those companies that actually produce a commodity and generate revenues. For example, gold producers must be assessed according to how much gold they produce, all-in cash costs, cash flow, net present value of estimated future cash flow, the payback of capital invested, remaining gold reserves and exploration potential and the price-to-earnings ratio.

The value of a producing mining company is affected by both internal and external factors. Internally, the company’s bottom line can be affected by processing lower or higher grade ore, by the shape of the mineral deposit that might result in dilution of good ore with waste rock, unwanted or environmentally unfriendly metals in the mineralized rock for which the company has to pay a penalty to the smelter, labor problems, etc. Increasingly, what is called social license must be obtained. If the local community hates a mining project or environmental stewardship is ignored, the project probably won’t go ahead.

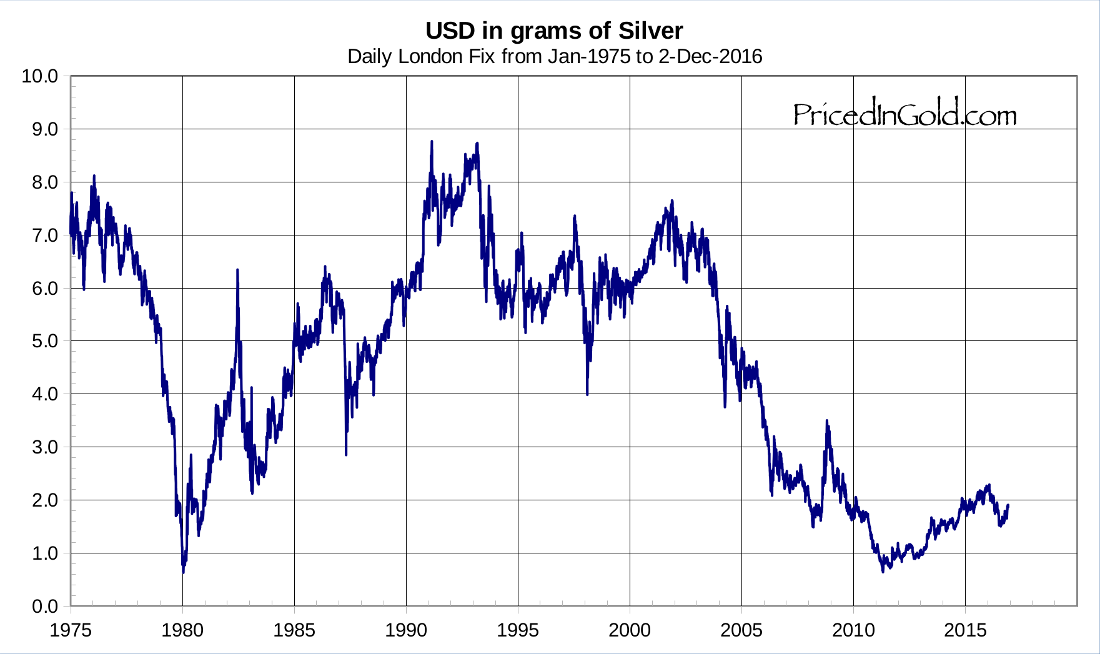

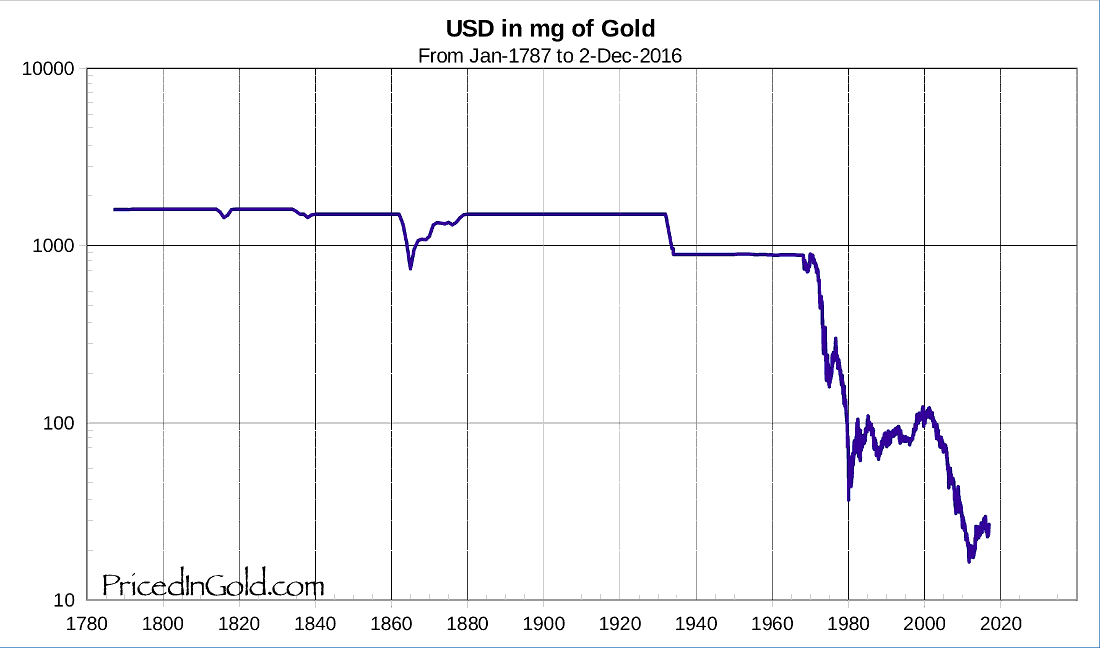

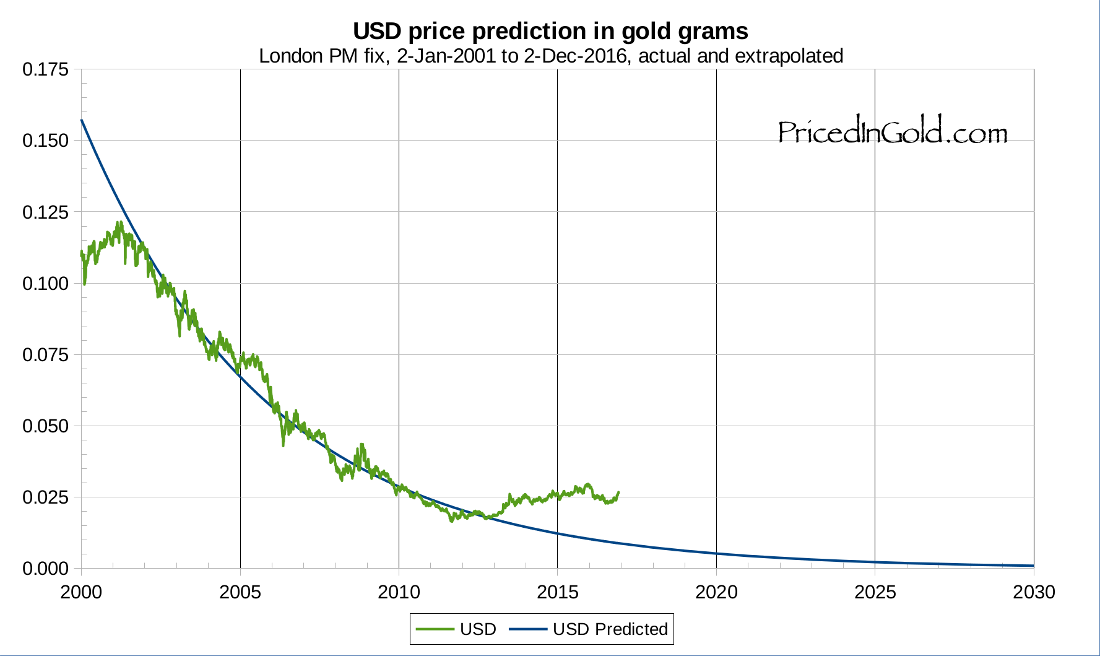

External factors that can affect profitability include the rise and fall of commodity prices, the rise and fall of domestic vs. foreign currencies, civil strife and warfare as well as nationalization of natural resources by the government. Trouble spots in the world can also have an effect on gold companies since the price of gold is sometime sensitive to global events.

For calculating the share value of a producing mining company, use the methods outlined in examples 2 and 3 – only this time you will be using real numbers generated by mining operations instead of figures estimated in feasibility studies.

Another common method of evaluating producing mining companies is to conduct a comparative analysis, which is, comparing your company of interest with other similar companies in order to discern if it is undervalued as compared to its peers. All of the evaluations we have covered may be influenced by where the metal of interest is, in its natural price cycle.

One might think that with all the challenges that mining companies face each day, it’s a wonder that any of them are successful. Yes, the mining industry is full of risks, but it is also full of opportunities for the investor. After all, even though most mining projects started out as long shots, enough have been successful to build a huge industry that supplies the world’s needs for mineral-based products, while employing tens of thousands of mine workers, as well as creating many related jobs in service industries.

Other Factors

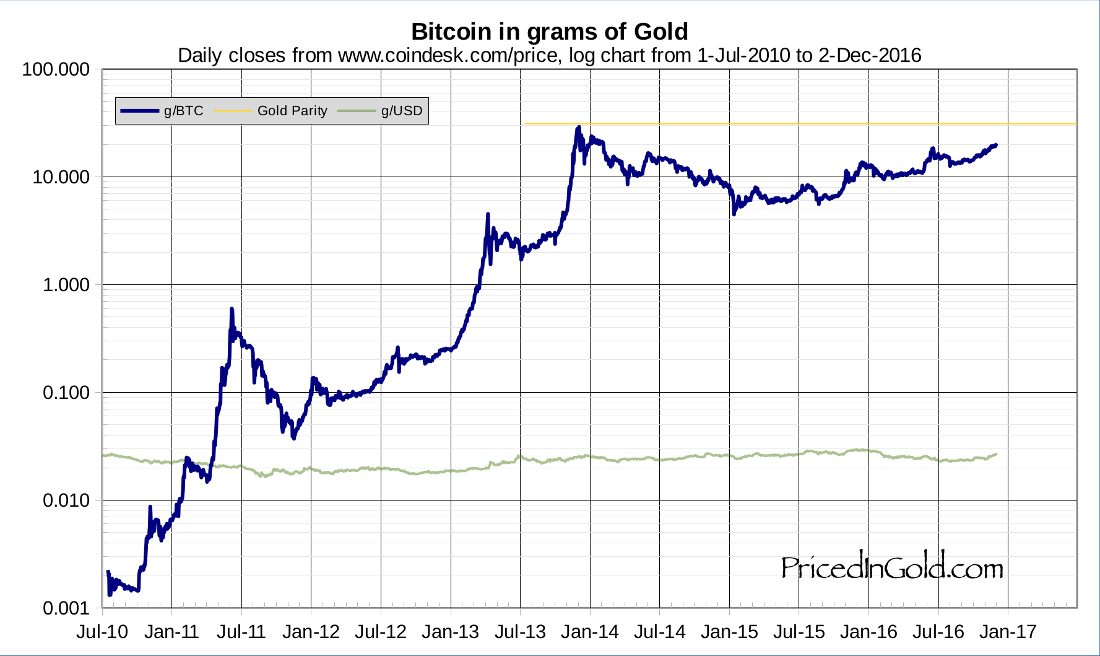

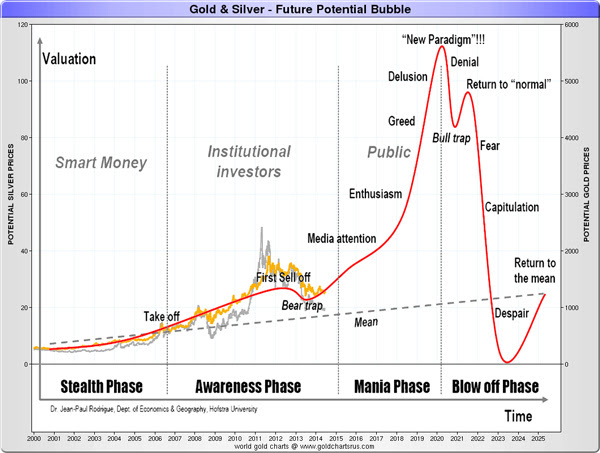

When evaluating mining companies, other factors come into play. These may include mass psychology, or market sentiment. Don’t underestimate the power of mass psychology. Sometimes investors are like a flock of birds flying in unison. This ‘herd mentality’ can drive share prices to unreasonable highs or absurdly low values.

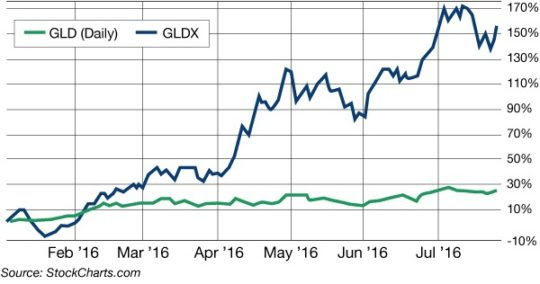

With rising commodity prices and a great demand for minerals, a bull market in mining stocks can develop. On the other hand, the mining bear market from 2012 to late 2015 resulted in mining stocks falling so out of favor that even great companies had ridiculously low shares prices. Investors shunned mining stocks even if the fundamentals were solid. It is certainly more fun to ride a wave of optimism where the trend is your friend propelling share prices higher than it is to fight against negative market sentiment.

The first half of 2016 saw a welcome recovery in mining stock valuations. As of late 2016, mining stocks are wavering; however, there are a number of favorable basics that could indicate the bull will return such as increasing demand for various base metals (zinc, for example) and industrial minerals (lithium, graphite, zeolite).

Don’t forget that a particular uptrend will eventually see a correction. Share prices may go up in the long-term, but there are always corrections. An investor may want to sell if things are looking ‘toppy’ and re-buy after the correction.

Another aspect to understand is just how your company of interest is going to increase shareholder value and its stock price. A company needs a logical and reasonable objective with its corporate and exploration plans going forward.

It helps to get arithmetic on your side. It is easier for a 50 cent stock to go to $1.00 than for a $2.00 stock to go to $4.00. In addition, you will make more money with the 50 cent stock because, being only 50 cents, you can buy a larger number of shares.

This doesn’t happen too often, but I am wary of companies where management pays themselves salaries that are far too high. Sometimes these salary figures are buried in the back of annual reports. It is hard enough to raise exploration funds, and the last thing an investor needs is management that milks the company’s treasury to support an extravagant lifestyle. This money should go into the ground.

A final word – timing is extremely important. Even if an investor has identified a good stock, it is better to buy a bad stock at a good time than a good stock at a bad time.

THE SPECIAL OFFER

Here is the coupon code that entitles a subscriber to a 1 year complimentary subscription to the online edition of Resource World Magazine:

Coupon code: 92C4FA

ABOUT THE AUTHOR

Ellsworth Dickson co-founded Resource World Magazine in 2002. A graduate of the Haileybury School of Mines, early in his career he worked in the geology departments of a silver-cobalt and copper mine as well as in structural geology for an engineering company. After learning the publishing business as a part owner of the North Shore News, Mr. Dickson became a mining journalist in 1983 and was editor of World Investment News in the late 1980s and the George Cross Newsletter in the 1990s.

Resource World Magazine reports on the business of mining, oil & gas, green technologies and the events that affect these sectors. The magazine provides a platform to profile companies on a non-advertorial basis while its non-paid editorial policy is integral to the success of Resource World Magazine. The magazine provides readers with an objective perspective and relevant, timely information and is committed to its policies of journalistic integrity and remains a reliable source for information about the resource sector.